Are You Wondering About Financial Aid? A Recent DVC Workshop Answered Many of the Questions You May Have

DVC Financial Aid For Tran$fer Flyer

April 20, 2021

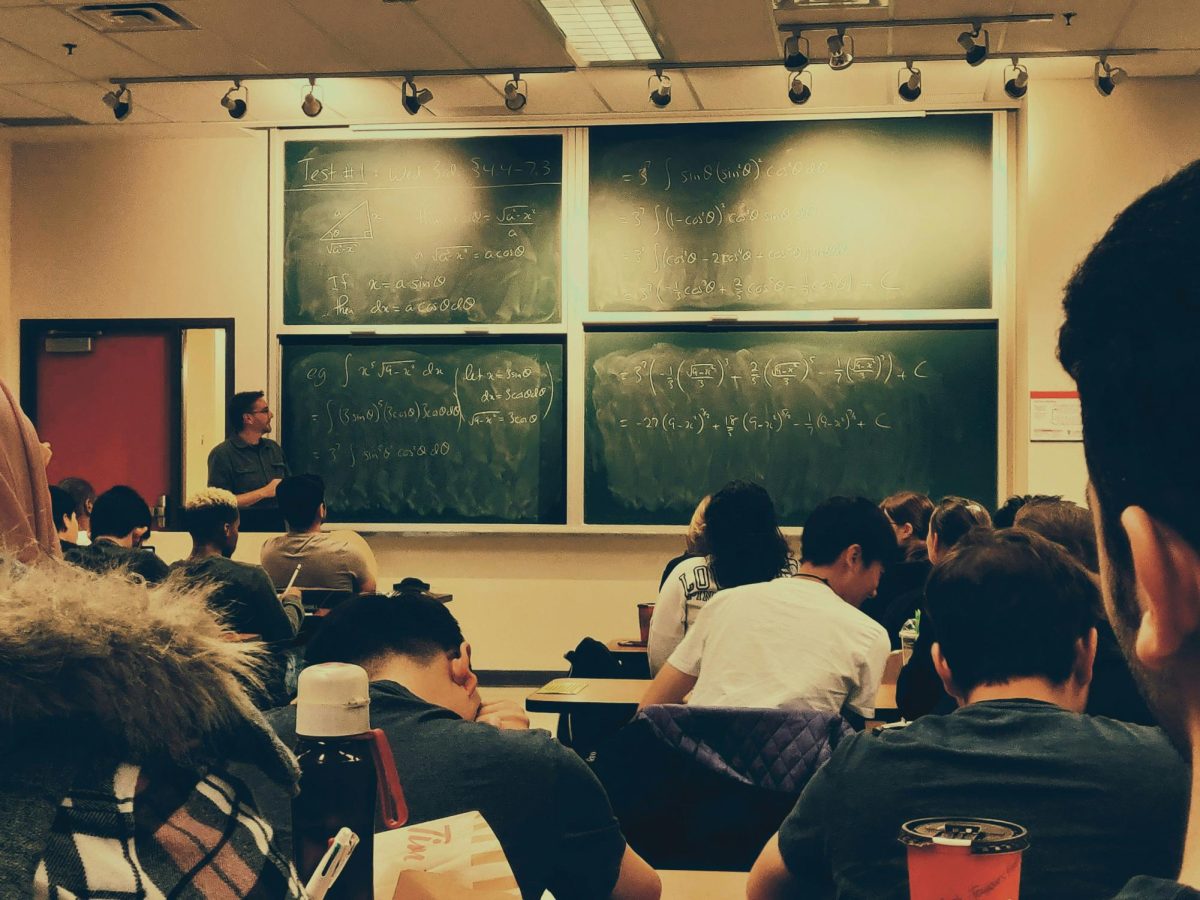

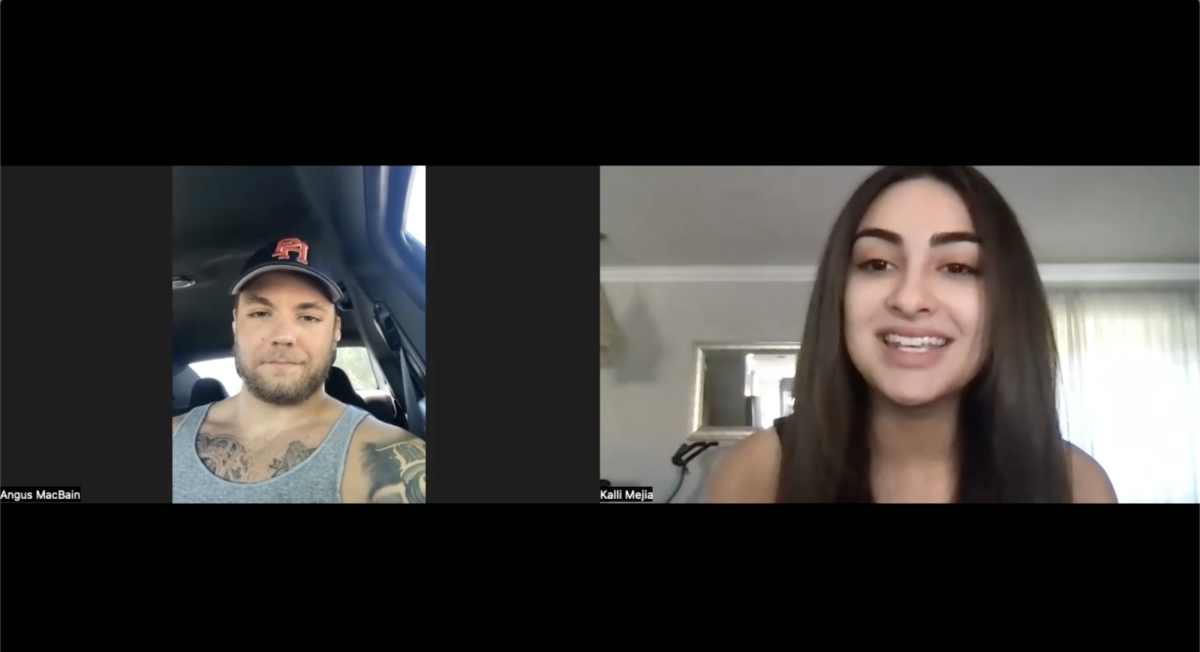

Last month, financial aid coordinator Eva Monteverde of Los Medanos College hosted a virtual workshop where she explained how transfer students from Contra Costa community colleges can benefit from federal and private loans, grants and other aid programs that assist those in need.

In order to be eligible for federally subsidized loans from the government, Monteverde said, students must be enrolled in at least six units of classes. Universities then determine the amount of money a student can borrow based on their school’s cost of attendance and any other financial aid one may already be receiving.

Each year, students must complete the Free Application of Federal Student Aid (FAFSA) in order to be considered for financial aid awards. For example, starting October 1, 2020, one could apply to be eligible for aid for the Fall 2021 and Spring 2022 semesters. Monteverde’s message: If you haven’t done it yet, it’s important to apply as soon as possible.

If students stop attending school or start taking less than six units of classes while receiving a federal loan, they have a six-month grace period before they have to start paying back the loan. Monteverde clarified that students are responsible for paying the interest during the time they have the loan.

She added that all loans have interest attached to them, and if a person chooses not to pay their interest while in school or during the grace period, the interest will start accruing.

In the workshop, Monteverde also explained the difference between private loans and federal ones. A federal student loan is money that comes from the government, with terms and conditions set by law, and can include benefits such as income-driven repayment plans and a fixed interest on the loan. Private loans, by contrast, are issued by nongovernmental entities like banks and credit unions.

Private student loans also have terms and conditions, usually set by the lender. For example, if a student borrows from a bank, the bank will dictate the terms of interest, repayment options and other conditions. As a result, those loans tend to have higher interest rates – a factor that many college students often overlook.

“I’ve seen a student take out a $2,000 private student loan,” said Monteverde, “and within two years they owed $40,000 because the interest is so high with private loaners, and the student didn’t see the fine print.”

Grants are another way students can pay for college. If a student is enrolled in 12 units or more per semester, they can receive six years of Federal Pell Grants, or until they receive their bachelor’s degree. The Federal Supplemental Education Opportunity Grant (FSEOG) is another grant available to students – and one that Monteverde encourages 4CD students to apply for as they seek to transfer to other colleges and universities.

Grants that students may be eligible to receive, up to the amount of $6,345, include:

Below is a list of other aid programs available to students, which Monteverde referenced during the presentation:

- If you work on campus at DVC, you are paid once a month at an hourly rate of $15/hour for on/off campus positions.

- Parent-plus loans are available for parents to assist their college-bound children with tuition fees. Find more information here.

- Financial Aid and scholarships are always awarded based on a student carrying 12 or more units.

- The Extended Opportunities Programs and Services (EOPS) bookbag is a program that

helps students buy books and supplies, among other items. The amount of aid provided can change. Find more information here.

- If you are a Dream Act student and don’t have an SSN, you can apply for FAFSA through the Dream Act application. Find more information here.