One of baseball’s fundamental problems is something that no other major sports league in America deals with: the absence of a salary cap. Rich teams win, poor teams suffer. The playing field needs to be leveled.

The Los Angeles Dodgers became 2024 World Series Champions after they beat the New York Yankees in five games in October, capturing their 7th championship ring since the team moved from Brooklyn to L.A. in 1958.

With most Major League teams now busy cutting salary costs and eager to capitalize on undervalued players, it begs the question: How did these two teams reach the pinnacle of the baseball world?

The answer is in many ways quite simple: $326 million (Dodgers) versus $303 million (Yankees).

In the case of the Yankees and Dodgers, it helps to begin with the two highest paid players in the game: Aaron Judge and Shohei Ohtani.

In the 2022 offseason, outfielder and home run slugger Aaron Judge signed a nine-year, $360 million contract to stay with the Yankees. The average annual value (AAV) of his contract, at $40 million, made him the richest player in baseball and the third-richest athlete in American history at the time.

For his part, Shohei Ohtani, the two-way Japanese phenom decided last year to stay in L.A., but swapped his Angels red for Dodgers blue when he signed the biggest contract in sports history: 10 years for $700 million.

At $70 million per year, the AAV on his contract totals more than the entire 2024 Oakland Athletics payroll.

Are these two players’ outlandish salary sums the main issue plaguing Major League Baseball? No, but they directly contribute to the problem currently facing the game.

Ball clubs can only spend as much money as their owners provide them. For example, John Fisher is the reason the Athletics have an annual payroll of less than $100 million, while Mark Walter and the Guggenheim Baseball Management group are the reason the Dodgers have free reign to sign whichever valuable player they choose.

It may come as little surprise that the teams’ respective records, year after year, reflect the impact of that spending.

Put simply, teams that spend big on players have thrived in recent years, which is why it’s time for a salary cap and floor: to shorten the gap between rich and poor teams. The benefits far outweigh the drawbacks, as other major American sports leagues have shown.

However, the success of an individual team is not indicative of a league-wide trend.

Take the NBA, for example. The league saw its most competitive regular season in 2023/24, due in part to the league’s continuance of a strict salary cap and floor, that is, the lowest amount of money a team must spend within a season.

Under the current rules, if an NBA team does not reach the floor, it must pay the league the amount of money it is not actively giving to the players on its roster. The NBA then redistributes that money to the players on the same team’s roster in the form of incentives and bonuses.

The result, in terms of league competition: over 60 percent of NBA teams finished at or above .500. Over the past 10 seasons, only two seasons have seen that margin reached.

By following this model, Major League Baseball can accelerate competition by forcing poorer teams to spend enough money to be competitive.

Another issue that contributes to Major League Baseball’s halt in fan growth, viewership, and profit as an industry is its use of the luxury tax.

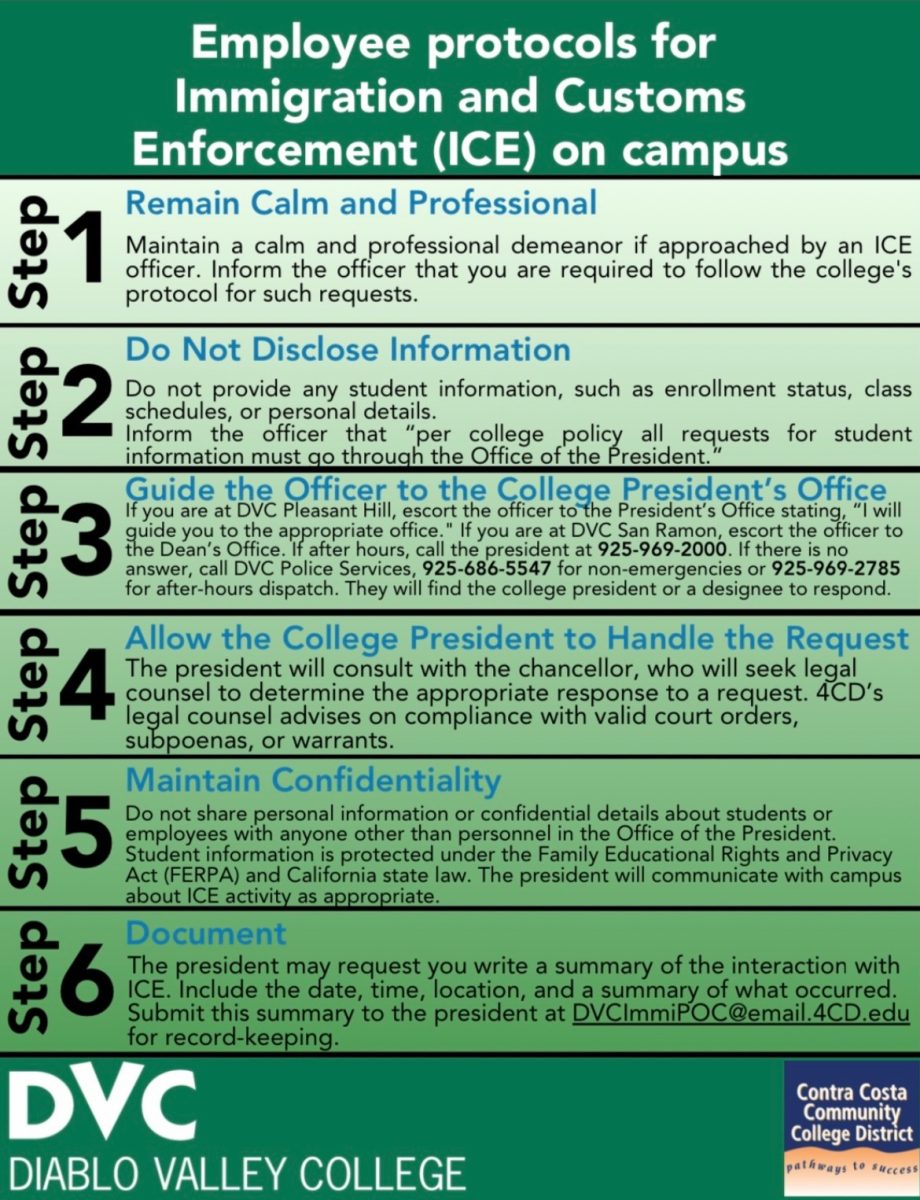

Every year, MLB sets a threshold, known as the luxury tax, that teams must stay under. For reference, the 2024 tax threshold was $237 million and the 2025 tax threshold will be $241 million. If a team passes that amount, they are dipping into the luxury tax. Passing the threshold results in a tax placed on every dollar a team spends over the threshold.

A great example to examine is the Dodgers, who spent $326 million in 2024, according to the intrinsic statistical website, Fangraphs. Being $89 million over the cap, they were projected to have spent $67.7 million on taxes, according to Sports Blog (SB) Nation.

This enables rich teams to spend more on players, as they can more easily afford the luxury tax. It gives poor teams another reason not to spend.

There are two solutions to fixing the luxury tax: 1) eliminate it and implement a hard cap, where teams cannot spend over a certain figure like in the NFL, or 2) continue with the luxury tax but with a salary floor and cap, as mentioned above, like the NBA.

The hard cap, as well as a proposed floor and cap, appears to provide more pros than cons. A major benefit of a hard cap, for example, would be that it increases revenue sharing among teams. In other words, expanded broadcasting of smaller-market teams would lead to more revenue. With increased revenue, more money could be distributed to the teams with less money, allowing them to gain ground on big-market teams. This would shorten the gap and allow smaller-market teams to pay more for players and become more competitive as a result.

What’s happening in baseball isn’t what we see looking around the rest of the American sports landscape. The MLB is stuck in the past, largely due to greedy team owners and commissioners over time allowing teams to spend without restriction. MLB needs to implement one of the two proposed options if it wants to see increased viewership, upward trends in revenue, and heightened competition like the NBA and NFL experienced after instituting salary caps.

Cleaning around the edges won’t cut it. The league can add in rules like the pitch clock to speed up games, which can increase the number of fans interested in watching the sport. But is that sustainable without the economic component to go with it? Until MLB deals with the vast salary discrepancy that separates the winning teams from the losing ones, Major League Baseball cannot claim to be “America’s pastime” any longer.

Abe Lincoln • Jan 23, 2025 at 1:43 am

Agree 100%. Amazing to me how short sighted baseball Commish and owners are. Baseball was America’s past time just a few decades ago. Distant 3rd in sports landscape.

Fans need to go on strike!

Steve Young • Dec 19, 2024 at 7:53 am

I agree 100%. If you were to give one person 100 million to start a company and another person gets 10 million, who do you think has a better chance of success. With Bally sports bankruptcy and dropping small market teams, this gap in rich and poor teams will get bigger. I have no idea why there is no action taken to fix this. It is sad.