Congressman Mark DeSaulnier talks tax reform, impact on education at Diablo Valley College town hall

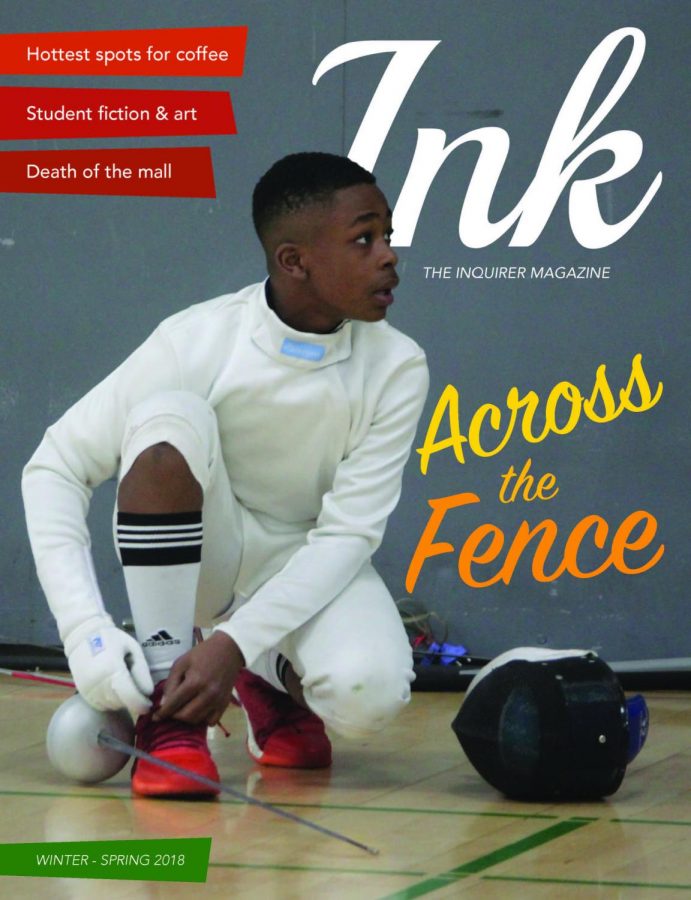

Photo of Rep. Mark DeSaulnier and student Johnnie Conner during town hall at Diablo Valley College held on Feb. 12. Photo courtesy of Rep. Mark DeSaulnier.

February 21, 2018

Since its passing in December the country has scrambled to figure out what the biggest tax reform since 1986 will mean. The answers are broad, complicated and differ depending on who you talk to.

During a town hall held at Diablo Valley College on Feb. 12, Rep. Mark DeSaulnier addressed concerns over the new tax reform, which is expected to add $1.8 trillion to our national debt over the next 10 years.

Speaking in interview before the town hall, DeSaulnier said students should expect both direct and indirect impacts from the new tax bill.

DeSaulnier described State and Local Tax (SALT) deductions to be an example of a large indirect change for students. Due to this, education funding would take a $250 billion cut over the next 10 years and put more than 38,000 education jobs at risk.

The Government Finance Officers Association describes the SALT deduction as being fundamental to the way states and localities budget for and provide critical public services.

In an Oct. 2017 interview on NBC’s Meet the Press, Treasury Secretary Steven Mnuchin said the Trump administration wants to eliminate SALT because it wants to get, “the federal government out of the business of subsidizing states.”

The tax reform would impact everything from tuition and financial aid to 529 accounts, interest rates and tax deductions.

According to the United States Securities and Exchange Commission a 529 account is a tax-advantaged savings plan designed to encourage savings for future college costs.

Under what DeSaulnier referred to as the “so-called PROSPER Act,” Public Service Loan Forgiveness would be eliminated, students would be forced to pay interest on loans right away and the process through which schools receive financial aid would be deregulated which DeSaulnier said would force schools to compete more for funding.

“We need to work on making higher education more accessible and affordable,” said DeSaulnier.

Writing via email, Aimee Wall, press secretary for DeSaulnier described him as actively working to increase access to higher education.

She cited his work on the Improving Access to Higher Education Act (H.R. 3199) and the Perkins Federal Loan Program as two examples of his commitment to higher education.

DeSaulnier described himself as a Republican turned Democrat who works well with both sides. He pointed out the value in civic engagement and debate.

During the town hall DeSaulnier also touched on a number of other topics concerning the nation and community. He included Deferred Action for Childhood Arrivals (DACA,) the creation of a bipartisan cancer caucus to improve doctor-patient relations, income inequality, race relations and campaign contributions to name a few.

Johnnie Conner, DVC student and political science major said, “the problems we face are bigger than you and me. It takes everybody.”

To view his Feb. 12 presentation please click here.

Chris • Apr 6, 2018 at 8:39 pm

Who will pay back this $1.8 trillion additional national debt?

Chris Bishop • Mar 19, 2018 at 12:06 pm

Nice summary of possible impacts on college students driven by recent Federal Tax reform.

Nichole Parkes • Mar 19, 2018 at 2:33 pm

Thank you for your comment Chris! Yes, the tax reform is very broad and complicated. Everyone, including students, will be affected.