Colleges need to provide debt relief

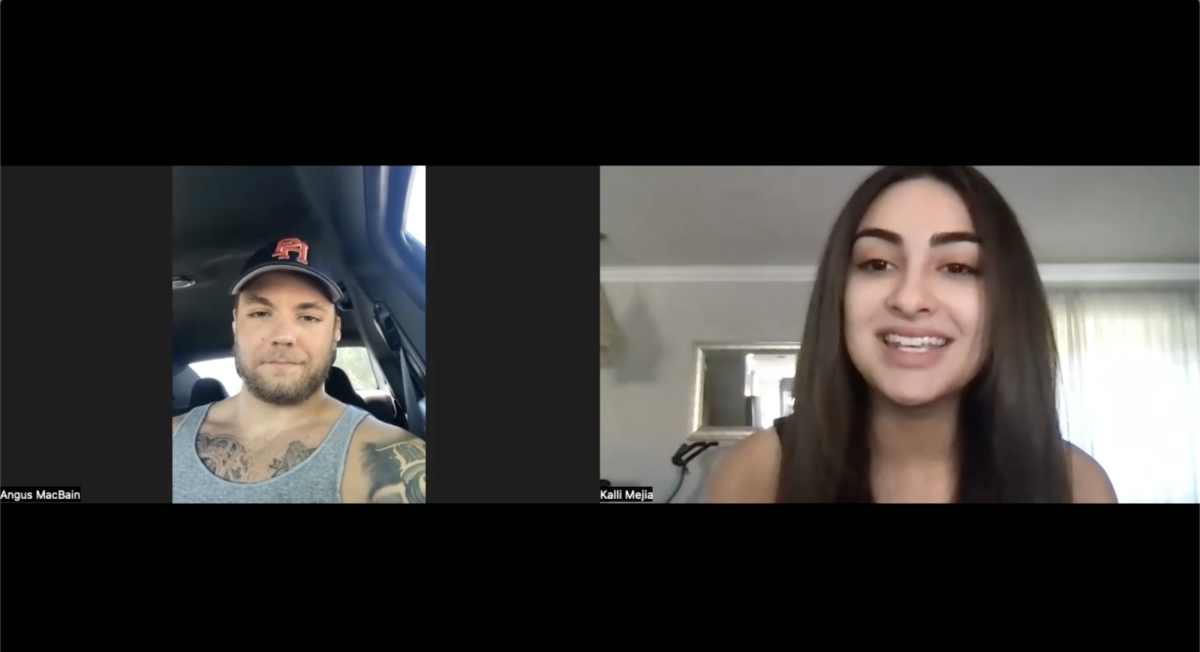

Students get transfer and financial aid information from visiting colleges at Transfer Day on DVC campus Oct. 26

October 25, 2015

“Is it even worth it?” That is the question that continues to linger as the cost of higher education rises and job opportunities dwindle.

A study conducted this year found the average cost for a full year of tuition at a community college to be about $3,347 and $9,139 at a public four-year university. Even though the cost for students continues to rise, the long term benefits of having a college degree are significant.

According to a recent Pew Research Center report, Americans 25 to 32 with a college degree made an average of $17,500 more annually than people with just a high school diploma. In today’s tough job market, having a college degree allows a person to be more competitive and valuable to an employer.

Pew Research Center also found that college educated millennials are less likely to be unemployed compared to a high school graduate, 3.8% vs 12.2%. As the economy continues to improve, more and more millennials are taking advantage of the financial resources that have become more readily available.

The advantages of having a college education last a lifetime, and statistics show an advanced degree will make you financially more stable; compared to a less educated individual. Georgetown University Center found that a college graduate will earn over $1 million more over a lifetime compared to high school graduate. That Is astonishing to think of the long term advantages an individual has from going to college.

Sabrina Holloran, 19, agrees, “I think in the long run, the benefits outweigh the cost because you’ll earn that back eventually, but the learning experiences are priceless.” As people come to their own conclusions if college is worth it, it’s pretty clear that educating your mind will unleash unforeseen possibilities.

Since we value having a thriving and educated populous, Americans must be committed to providing a world class education — for every person — regardless of their financial status.

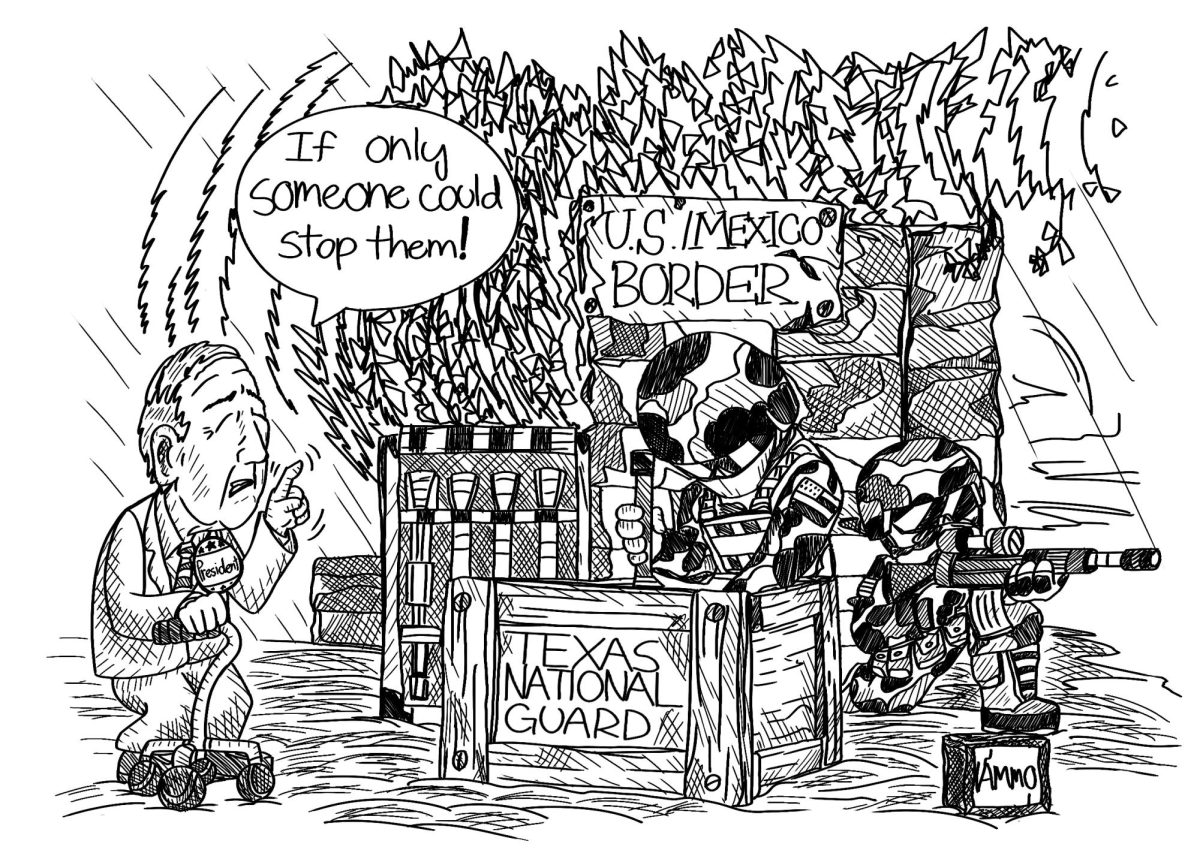

Unfortunately, our system caters towards a wealthier demographic.

With the exponential growth of college tuition, we essentially discriminate against those who have less. Rather, we should uplift people and provide them a pathway to their educational goals.

Lawmakers and college officials, who continue to raise college’s erratic tuitions, are forcing many students to take on multiple jobs in order to pay for their education. Our education system has created a new generation of people drowning in college debt.

The Federal Reserve Bank of New York reports that the average debt in 2011 was $23,300 with 10 percent owing more than $54,000 and 3 percent more than 100,000. The debt that college students are taking on is a lifetime burden.

Federal and state aid must be expanded to help ease this burden of student debt. If Federal Pell grants were expanded, it would allow millions more of low income people to attend college and help cover the cost of tuition for many more students.